All Categories

Featured

Table of Contents

Nevertheless, keeping all of these phrases and insurance kinds directly can be a frustration - mis sold mortgage insurance. The following table puts them side-by-side so you can rapidly differentiate among them if you obtain perplexed. One more insurance coverage kind that can pay off your home mortgage if you die is a common life insurance coverage plan

A is in location for an established number of years, such as 10, 20 or 30 years, and pays your recipients if you were to pass away throughout that term. A supplies insurance coverage for your entire life period and pays out when you pass away.

One usual guideline of thumb is to intend for a life insurance plan that will certainly pay approximately ten times the policyholder's wage amount. You may select to use something like the Penny technique, which includes a family's financial obligation, income, home mortgage and education and learning expenditures to determine exactly how much life insurance is required.

It's also worth keeping in mind that there are age-related limits and limits enforced by nearly all insurers, who often will not offer older buyers as lots of choices, will certainly charge them extra or may reject them outright.

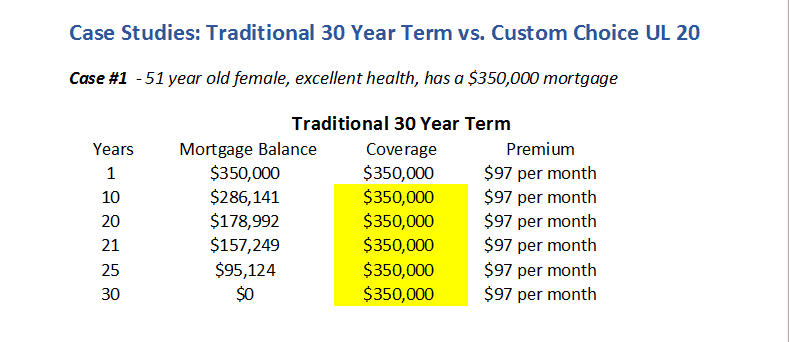

Below's how home mortgage defense insurance determines up against common life insurance policy. If you have the ability to receive term life insurance policy, you ought to stay clear of home mortgage defense insurance (MPI). Compared to MPI, life insurance coverage provides your family members a less expensive and more flexible benefit that you can count on. It'll pay the same amount no issue when in the term a death happens, and the money can be used to cover any type of expenditures your family considers needed during that time.

In those circumstances, MPI can provide great satisfaction. Just be sure to comparison-shop and review every one of the great print prior to registering for any type of policy. Every home mortgage defense choice will have countless guidelines, regulations, advantage choices and disadvantages that need to be considered very carefully versus your exact situation (mortgage shield).

Does Everyone Need To Pay Mortgage Insurance

A life insurance coverage policy can assist settle your home's home mortgage if you were to die. It's one of numerous methods that life insurance policy might aid safeguard your loved ones and their economic future. Among the most effective means to factor your home mortgage right into your life insurance coverage demand is to speak with your insurance coverage representative.

Rather than a one-size-fits-all life insurance policy plan, American Domesticity Insurance coverage Company supplies plans that can be designed specifically to satisfy your family members's demands. Right here are some of your options: A term life insurance coverage policy. credit life insurance for home loan is energetic for a particular quantity of time and typically provides a larger quantity of insurance coverage at a reduced price than a permanent plan

Instead than just covering a set number of years, it can cover you for your whole life. It likewise has living benefits, such as cash money worth build-up. * American Family Members Life Insurance policy Firm offers various life insurance coverage policies.

They may additionally be able to assist you locate spaces in your life insurance policy protection or brand-new methods to save on your other insurance policy plans. A life insurance beneficiary can select to use the death benefit for anything.

Life insurance policy is one way of assisting your household in repaying a mortgage if you were to die prior to the mortgage is completely repaid. No. Life insurance coverage is not compulsory, yet it can be a vital component of assisting see to it your enjoyed ones are financially protected. Life insurance proceeds may be used to assist settle a home loan, yet it is not the like home loan insurance policy that you could be called for to have as a problem of a funding.

Life Insurance On Mortgage Should I Get It

:max_bytes(150000):strip_icc()/insurance_final-636cb6bc31de489f836f16f029289faf.jpg)

Life insurance coverage may assist ensure your home stays in your family by providing a death advantage that may assist pay down a home mortgage or make crucial acquisitions if you were to pass away. This is a quick description of coverage and is subject to policy and/or motorcyclist terms and conditions, which may vary by state.

The words life time, lifelong and irreversible are subject to plan conditions. * Any car loans taken from your life insurance policy policy will accrue rate of interest. do you have to have life cover with a mortgage. Any type of exceptional loan balance (financing plus interest) will be deducted from the survivor benefit at the time of case or from the cash money value at the time of surrender

Price cuts do not apply to the life plan. Plan Forms: ICC18-33 (10 ), ICC18-33 (15 ), ICC18-34 (20 ), ICC18-35 (30 ), L-33 (10 )(ND), L-33 (15 )(ND), L-34 (20 )(ND), L-35 (30 )(ND), L-33 (10 )(SD), L-33 (15 )(SD), L-34 (20 )(SD), L-35 (30 )(SD), ICC18-36 (10 ), ICC18-36 (15 ), ICC18-36 (20 ), ICC18-36 (30 ), L-36 (10 )(ND), L-36 (15 )(ND), L-36 (20 )(ND), L-36 (30 )(ND), L-36 (10 )(SD), L-36 (15 )(SD), L-36 (20 )(SD), L-36 (30 )(SD), ICC17-225 WL, L-225 (ND) WL, L-225 WL, ICC17-227 WL, L-227 (ND) WL, L-227 WL, ICC17-223 WL, L-223 (ND) WL, L-223 WL, ICC17-224 WL, L-224 (ND) WL, L-224 WL, ICC17-228 WL, L-228 (ND) WL, L-228 WL, ICC21, L141, MS 01 22, L141, ND 02 22, L141, SD 02 22.

Home loan defense insurance policy (MPI) is a different kind of safeguard that might be helpful if you're not able to settle your mortgage. Home loan security insurance is an insurance coverage plan that pays off the remainder of your home mortgage if you pass away or if you come to be impaired and can't function.

Like PMI, MIP shields the lending institution, not you. Unlike PMI, you'll pay MIP for the period of the financing term. Both PMI and MIP are called for insurance policy protections. An MPI plan is totally optional. The amount you'll spend for home mortgage protection insurance relies on a range of variables, consisting of the insurer and the present equilibrium of your home mortgage.

Still, there are advantages and disadvantages: Many MPI plans are provided on a "assured acceptance" basis. That can be useful if you have a wellness problem and pay high prices for life insurance policy or struggle to acquire protection. mortgage protection insurance us. An MPI policy can supply you and your family members with a feeling of safety

Insurance Against Home Loan

It can also be practical for individuals that do not get approved for or can not pay for a standard life insurance policy policy. You can select whether you need mortgage defense insurance and for for how long you need it. The terms typically range from 10 to thirty years. You could want your home loan defense insurance term to be close in length to the length of time you have actually entrusted to settle your mortgage You can cancel a home loan security insurance plan.

Latest Posts

Free Instant Life Insurance Quotes

Funeral Preplanning Insurance

Funeral Expense Plans